Western North Carolina small business owners are making a significant economic impact by creating 980 jobs, launching 91 new businesses, and expressing consistent growth capital needs across the region. The 2024 Local Business Impact Survey, presented by Mountain BizWorks, highlights these key findings, underscoring the continued growth in the small business landscape and the emerging need for accessible funding to sustain and expand these enterprises.

Key Takeaways

- Strong Economic Contributions: Western North Carolina’s small businesses, supported by Mountain BizWorks, created 980 new jobs and launched 91 new ventures this year, demonstrating significant economic growth.

- Consistent Capital Needs: A substantial 74% of small businesses indicated a need for additional capital under $100K in the coming year, with entrepreneurs of color, particularly women, facing heightened challenges. This underscores the ongoing need for accessible and affordable funding options.

- Financial Management Insights: While 98% of surveyed entrepreneurs use some form of bookkeeping, with QuickBooks being the most popular tool, only 14% report excellent financial health. This highlights a need for enhanced financial management support and planning.

- Generational Wealth Opportunities: Despite economic fluctuations, 36% of entrepreneurs experienced a personal income increase of 5% or more, signaling progress towards building generational wealth. However, there remains a significant opportunity to further elevate these outcomes.

The 2024 Local Business Impact Survey offers a compelling snapshot of the resilience, challenges, and opportunities facing small businesses across Western North Carolina. Over the past year, Mountain BizWorks has played a pivotal role in supporting these entrepreneurs as they navigate growth and change. From the launch of new businesses to the retention of valuable jobs, the survey reveals not only the economic impact of these enterprises but also the ongoing need for accessible capital and robust financial management. This report delves into these key findings, highlighting the critical support systems that empower our local entrepreneurs to thrive in an ever-evolving marketplace.

Participation & Demographics

Each year, we use the Local Business Impact Survey to better understand the economic impact small business owners are making across the region and to refine our offerings based on these insights. This year, we invited 1,277 local entrepreneurs who had engaged with one or more Mountain BizWorks services in the past year to participate in the survey. With 357 responses, representing 28% of the total, the data provides valuable insights into these businesses and, to some extent, the broader WNC small business landscape.

These findings provide valuable insights into these businesses, and to a degree, WNC small businesses more broadly, however the survey group is not necessarily a representative sample of WNC businesses overall and we encourage caution when drawing general conclusions.

Responses were provided from across our Western North Carolina service area with 23 of our 26 counties represented in the response pool. Of these respondents, 58% were women-owned businesses and 26% of were businesses owned by people of color. 31% of respondents were based in rural communities.

Mountain BizWorks Impact

Each of the respondents included in this survey were actively engaged with Mountain BizWorks over the past 12 months with a loan, class participation or on-one-one specialized business coaching. We are grateful to play a role in the small businesses across the region as they start, grow and thrive.

Each of the respondents included in this survey were actively engaged with Mountain BizWorks over the past 12 months with a loan, class participation or on-one-one specialized business coaching. We are grateful to play a role in the small businesses across the region as they start, grow and thrive.

One key marker of economic growth is the ability to create and sustain the local workforce with jobs. Entrepreneurs who worked with Mountain BizWorks this year reported the creation of 980 news jobs and the retention of 1,472 jobs within their business. The job creation was almost identical to the year before but 20% more positions remained open which could signal a tighter employment environment.

In addition, there were 91 new small businesses that reported opening their doors in 2023. This is keeping in trend with the statewide acceleration of small business creation since the beginning of the global pandemic in early 2020.

We recognize that small businesses are the backbone of the local economy, and we’re grateful to support their growth. Mountain BizWorks remains committed to keeping capital both accessible and affordable, with average interest rates declining over the past 12 months to stay between 7-9% (compared to an 11% average for bank financing). Thanks to our community-focused investors and funding partners, we can offer flexible capital that provides entrepreneurs with the funds they need to start and grow. Additionally, our learning programs—courses and coaching—equip our clients with the skills and support they need to thrive, both before and after financing.

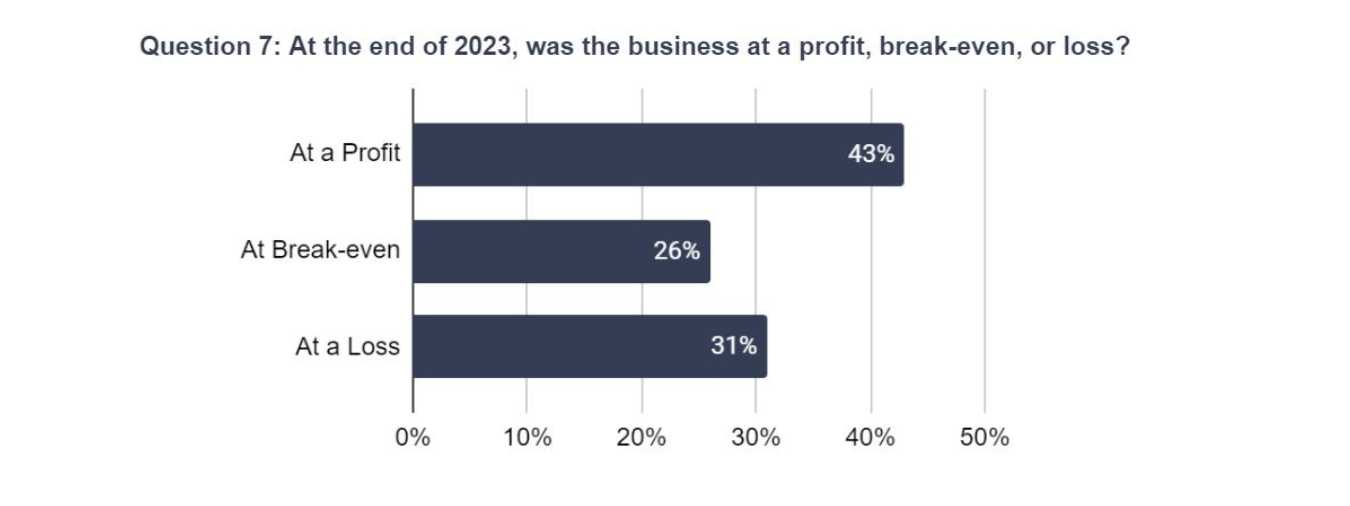

Despite the ups and downs during the COVID-19 pandemic and beyond, our clients have shown impressive resilience. They’ve kept their profits, revenue, and household income steady, proving they can handle tough economic times and adapt to changing markets. They are well positioned for growth and increased profitability.

It’s worth noting that 36% of entrepreneurs, or 112 people, reported a personal income increase of 5% or more. These business owners not only boosted their revenue and profitability but are also on the path to building generational wealth through entrepreneurship. While we celebrate this achievement, it also underscores an opportunity to further elevate these outcomes, and we are driven to continue supporting their growth.

Small Business Financial Health Analysis

As a CDFI (Community Development Financial Institution), we are committed to help businesses become ready for the access to capital to start, grow and thrive. We know a few vital pieces are strong bookkeeping practices, an understanding of financial needs within the business, and the ability to plan for the future. As a unique focus within the 2024 survey, we asked clients to help us provide benchmark information around their bookkeeping and financial wellness practices.

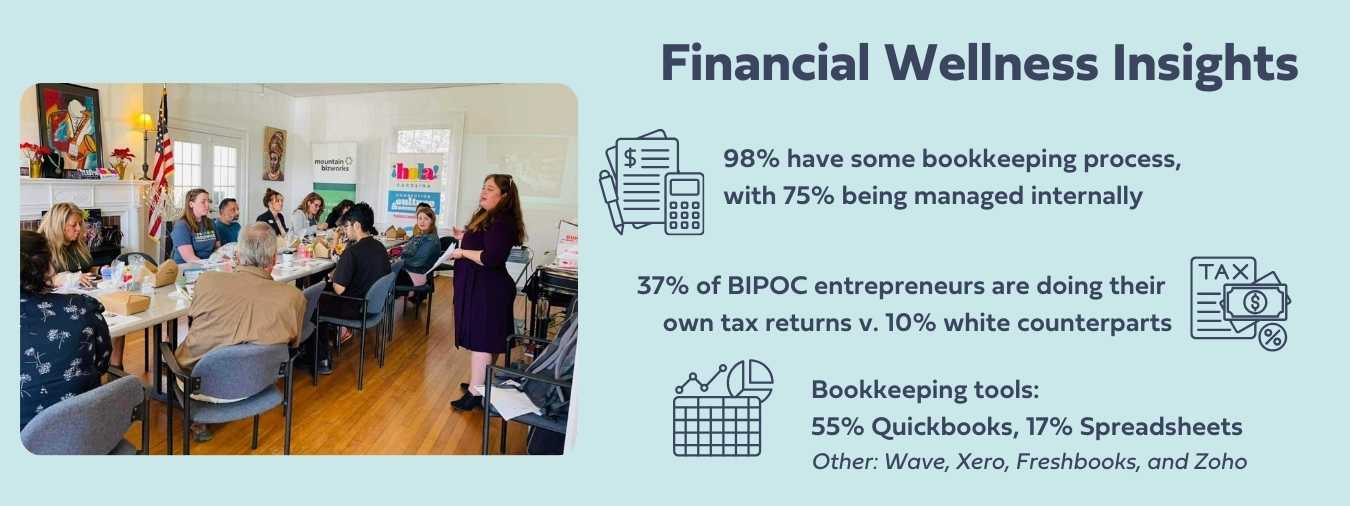

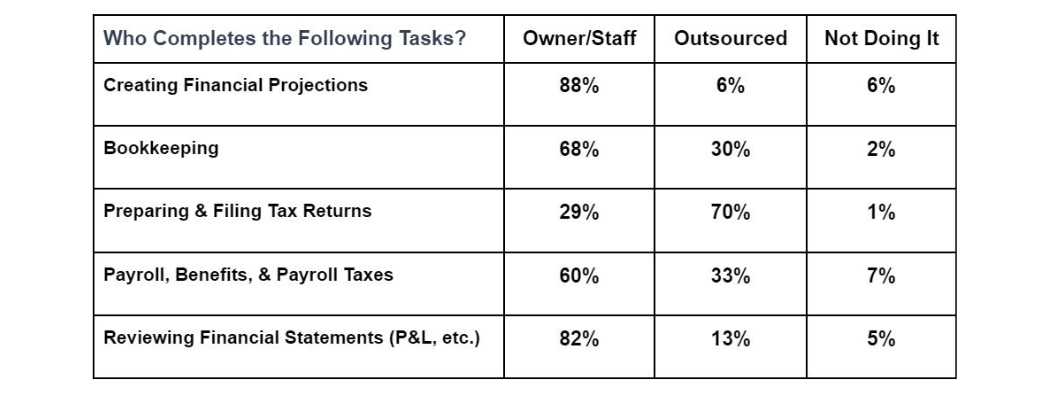

We found that 98% of surveyed entrepreneurs have implemented some form of bookkeeping practices, with 75% managing them internally rather than outsourcing. Over half (55%) use QuickBooks as their primary software for tracking cash flow and profit and loss, while other tools like FreshBooks, Wave, Xero, and Zoho account for just 6% combined. Additionally, 17% of businesses owners are using spreadsheets or paper journals to track their finances.

Overall, entrepreneurs that responded report a good financial foundation in regards to bookkeeping practices and understand their growth needs of their business. It is important to note that while we are confident in our sample size with these findings, there is the potential bias for self-selection in participating for small business owners who do not feel as confident or prepared to discuss their financial practices and outcomes.

To look at the overall financial health of those surveyed, we used seven markers as indicated below:

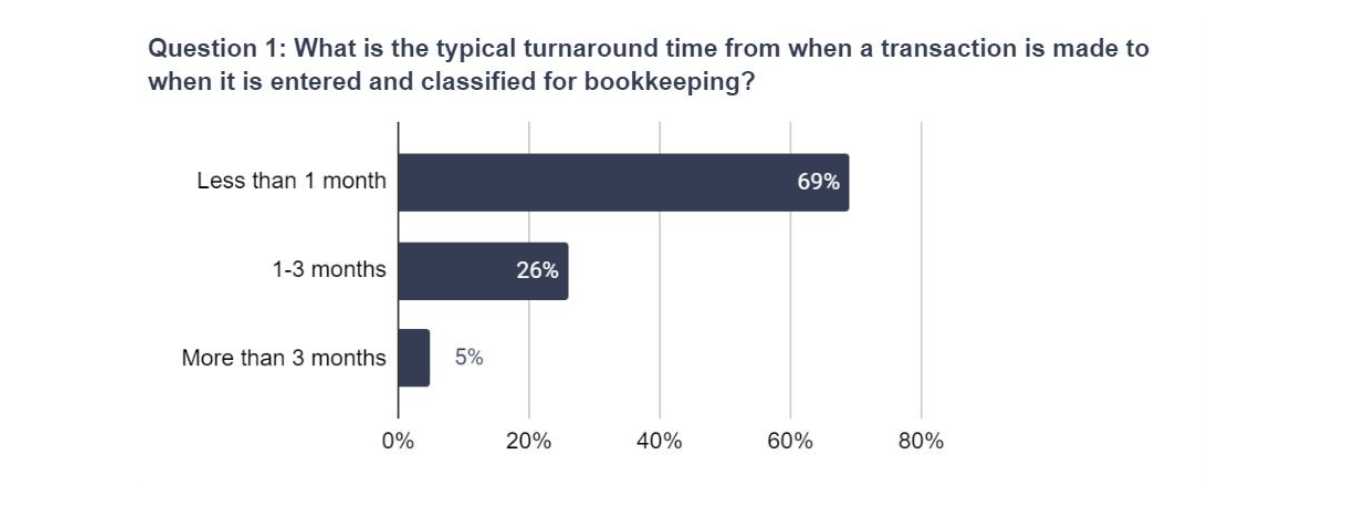

- Turnaround time for bookkeeping

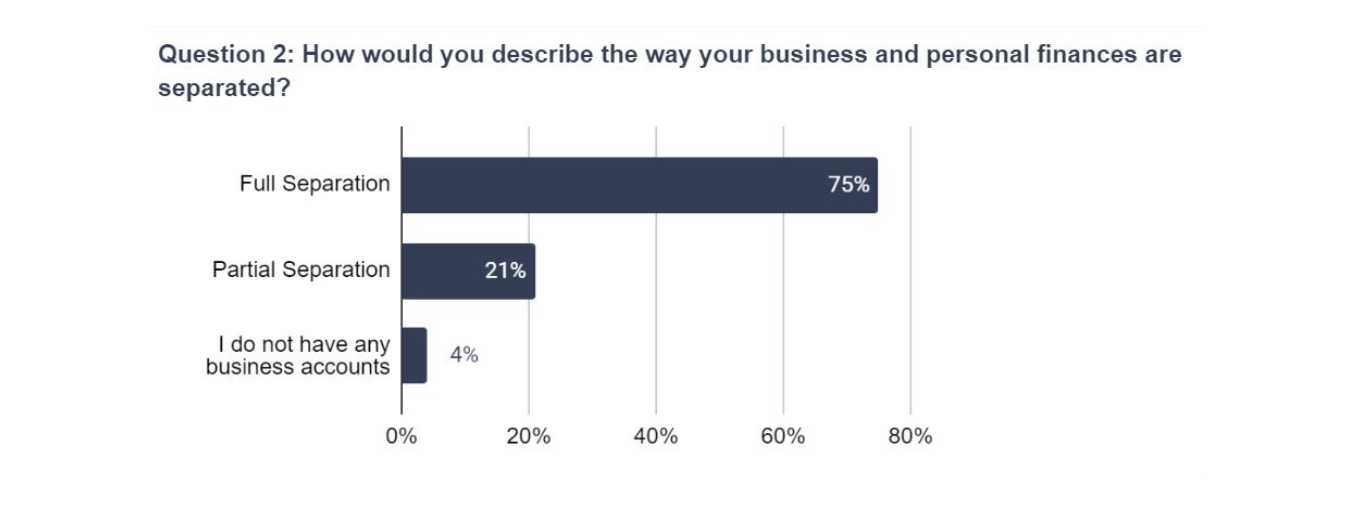

- Separation of business and personal finances

- Review of Profit & Loss Statement

- Financial Planning and Management

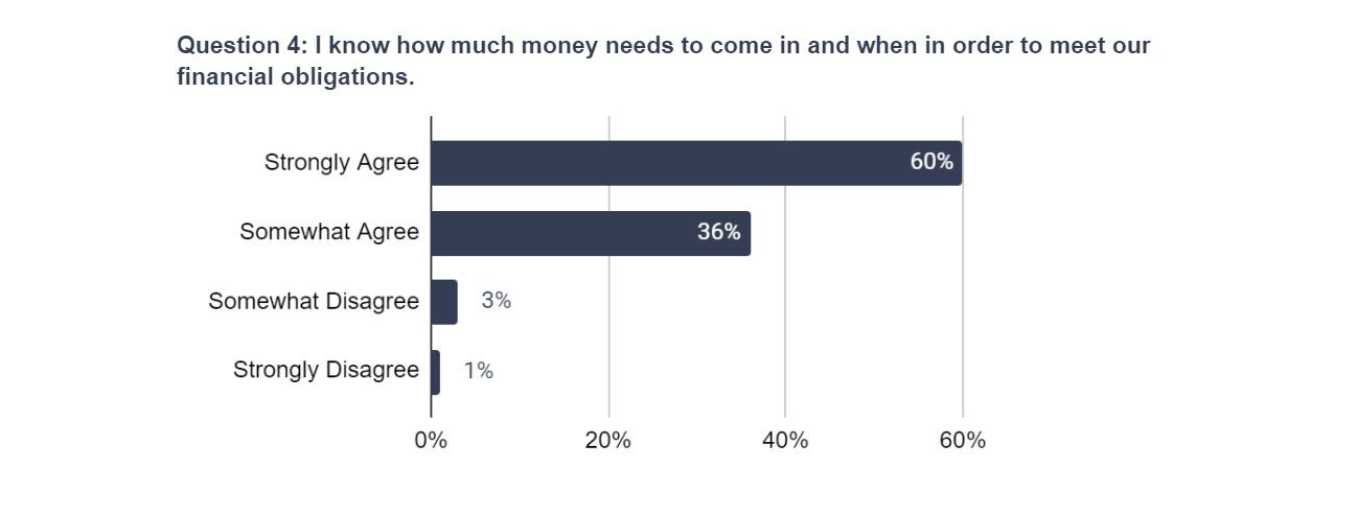

- Understanding cash flow needs

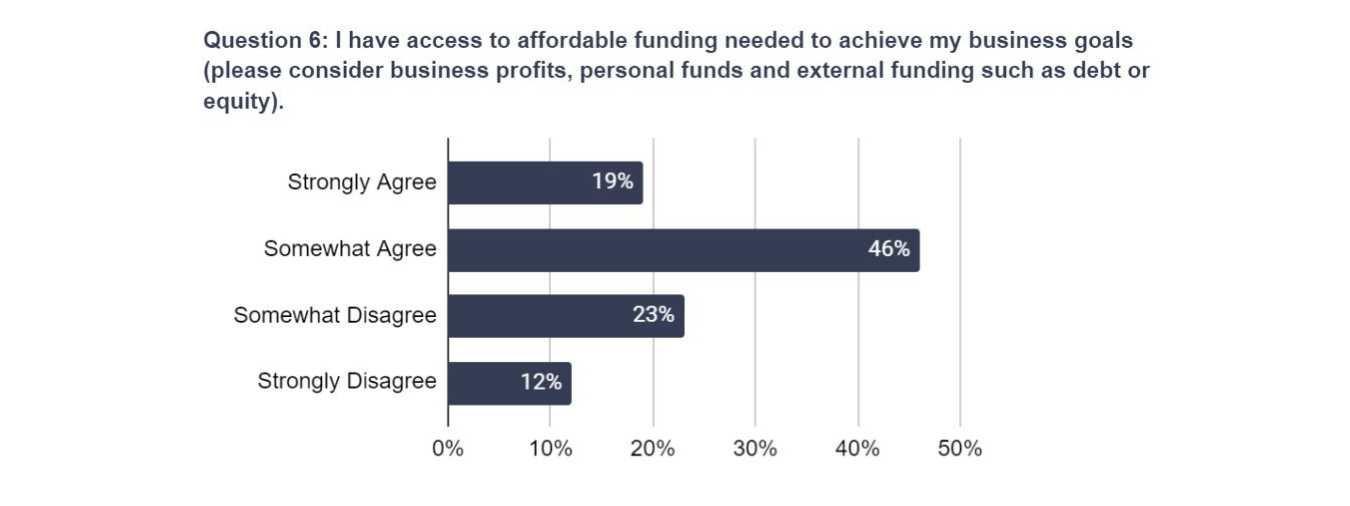

- Access to affordable funding

- Profitability, Break Even or Loss status at the end of 2023.

In addition, we included a review of business financial responsibilities to understand more about how entrepreneurs are engaging with their business finances.

Small Business Financial Health Scoring

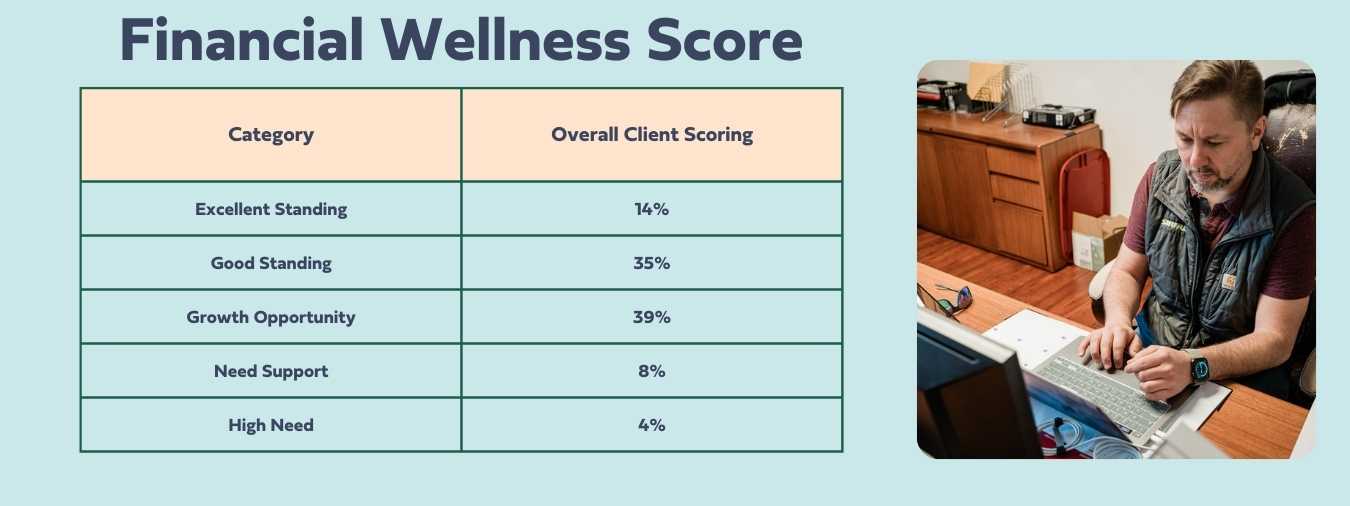

We then used that information to analyze the financial wellness of small businesses across the region. We found that small business owners fell into five categories as follows:

Determinants for each wellness score :

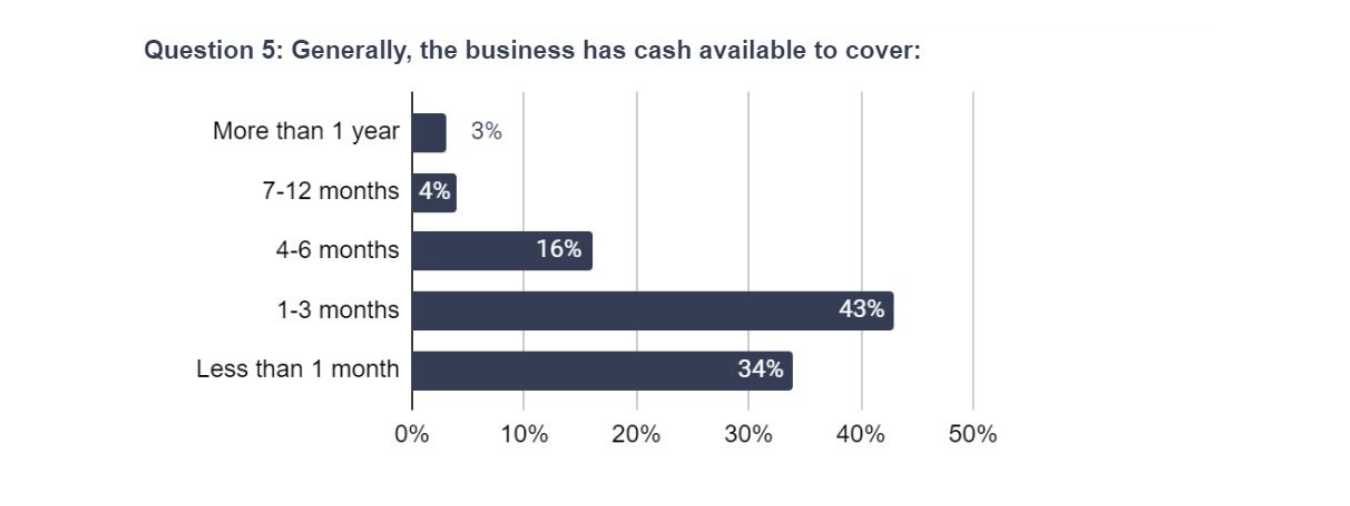

- Excellent Standing These businesses are well established, follow financial management practices, have an understanding of cash flow needs, and have the ability to manage month to month fluctuations within their business.

- Good Standing – Businesses within this category have strong financial practices and understanding with areas of growth around strengthening their cash reserve and access to affordable funding.

- Growth Opportunity – Many of these businesses have the processes in place for bookkeeping, but they do not have a full understanding of how to plan for the future or have cash flow flexibility in their business for unexpected expenses.

- Need Support – This business group represents those who have not yet implemented key structures such as separation of personal and business finances, reviewing profit and loss statements regularly, or having cash reserves for growth needs.

- High Need – While small, this group represents clients that do not have proper financial management practices in place and do not yet have the knowledge or understanding of their business finances required to make sound financial decisions.

When broken out by program, those that scored the highest in this category were engaged in our ScaleUp and Waypoint Accelerator Cohorts. These programs both have application processes and are generally geared toward more established businesses. They also integrate education around financial management practices at a deep level within their curriculum.

As an organization, we will use these insights to refine and expand our offerings around financial wellness and preparation. Our Financial Series course is offered both virtually and in person, and our team of small business coaches are available to work one-on-one with entrepreneurs to strengthen the financial practices within these enterprises.

View Upcoming Classes Learn About Business Coaching

Access to Capital

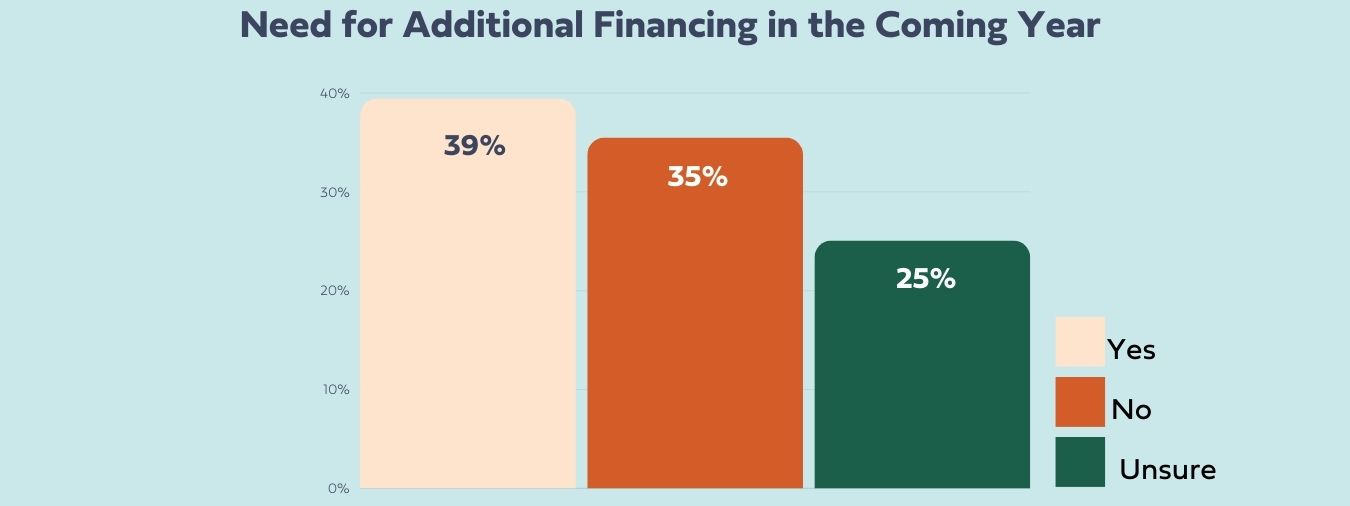

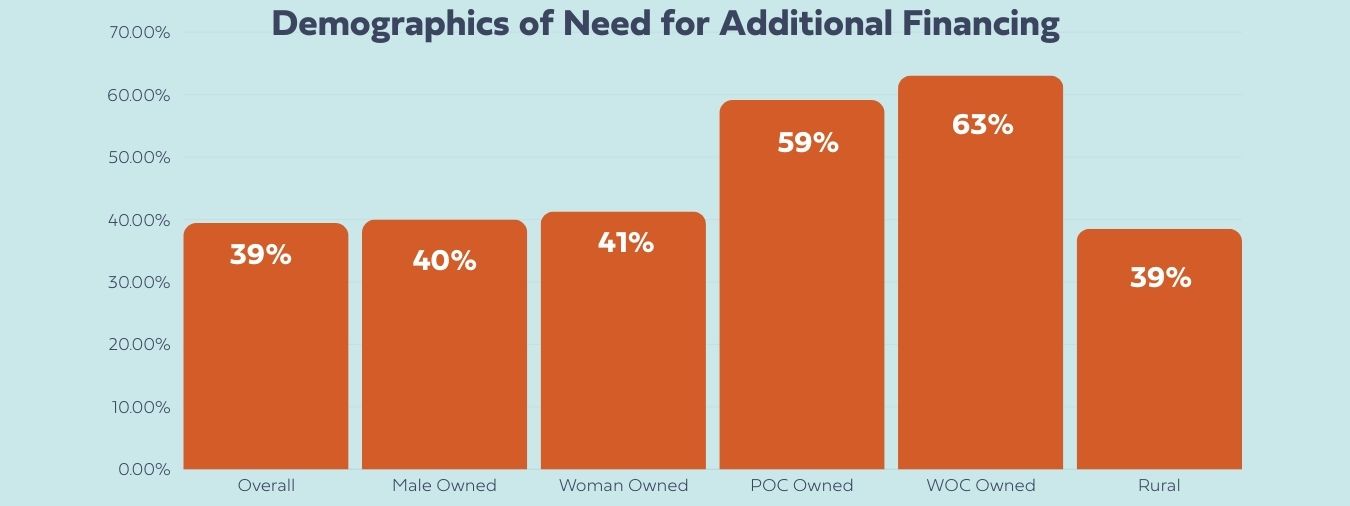

There is a strong need for continued access to capital in the coming year for small business owners; 74% of respondents reported they may need access to additional capital in the coming year. Entrepreneurs of color – and particularly women entrepreneurs of color – indicated the greatest need in this area.

As a community lender, founded in 1989 on micro-lending opportunities, we were encouraged to see that 63% of borrowers anticipated needing under $100k, with a higher indication of loans under $50k needed from entrepreneurs of color to start or grow their business.

The highest reported need for capital was to support growth opportunities with secondary needs indicated around marketing, equipment and working capital. The growth capital needs are a positive indicator as businesses in our region continue to be resilient within both rural and urban communities.

When asked if business owners felt that they had access to affordable capital for their needs, just over half strongly agreed or agreed that this was true for them. Entrepreneurs of color reported feeling less confident that they had access to the affordable capital they need to start or grow their business.

With the rising costs of starting a business and the current interest rate environment, we have remained focused on keeping our rates affordable for entrepreneurs. Over the past three years, we’ve prioritized affordability and have even reduced our average rate, demonstrating our commitment to providing consistent, accessible funding for those we support.

We deeply appreciate the ongoing support from our dedicated funders and community partners, who have been instrumental in advancing initiatives like the Catalyst Fund and community back-guaranteed pools such as the MCCF and the Catalyst Community Guarantee Pool which have ensured our ability to lend to small who business owners who may not have the personal collateral or friends and family funding required to get a loan. Learn more about the Catalyst Fund and Mountain BizWorks’ community focused lending here.

Key Takeaways

- Strong Economic Contributions: Western North Carolina’s small businesses, supported by Mountain BizWorks, created 980 new jobs and launched 91 new ventures this year, demonstrating significant economic growth.

- Consistent Capital Needs: A substantial 74% of small businesses indicated a need for additional capital under $100K in the coming year, with entrepreneurs of color, particularly women, facing heightened challenges. This underscores the ongoing need for accessible and affordable funding options.

- Financial Management Insights: While 98% of surveyed entrepreneurs use some form of bookkeeping, with QuickBooks being the most popular tool, only 14% report excellent financial health. This highlights a need for enhanced financial management support and planning.

- Generational Wealth Opportunities: Despite economic fluctuations, 36% of entrepreneurs experienced a personal income increase of 5% or more, signaling progress towards building generational wealth. However, there remains a significant opportunity to further elevate these outcomes.

Acknowledgments:

The success of Mountain BizWorks’ 2024 Local Business Impact Survey is thanks to the strong support of a few key partners.

First off, a huge thank you to all the business owners who took the time to share their experiences with us. Your insights are incredibly valuable, and we’re dedicated to using this information to guide our efforts in the future.

We also want to give a big shoutout to our sponsors, Altura Architects and Trout Insurance Services. Your support means a lot and shows your commitment to listening to the local business community.

Finally, a big thank you to our two incredible summer impact interns who took a lead role in conducting the survey and compiling and analyzing the results. Alisa Cruz-Méndez joined us from the University of North Carolina Chapel Hill and Fletcher Abee from the University of North Carolina Asheville. Thank you Alisa and Fletcher for making this such a productive and fun summer!

We trust that this has provided you with a greater insight into the WNC region and the existing landscape of local entrepreneurship. If you are a business owner, we look forward to continuing to assist you in reaching your goals – check out our upcoming learning and lending offerings. If you are a community member and want to engage at a deeper level, learn more about supporting our work here.